Table of Contents (click to expand)

Developed countries are skeptical of adopting cryptocurrency, as they are unstable and controlled by private authorities. This also poses a challenge to the central banks’ policy-making role of controlling the flow of currency in the economy.

Cryptocurrencies like Bitcoin, Dogecoin and Ethereum have taken the economy by storm, but central banks worldwide are skeptical about adopting it. Some have outright classified it as gambling. Let’s dive in to understand why central banks are skeptical about cryptocurrency.

How Does Anything Become Currency?

We’ve often seen in shows and movies that prison inmates use commodities as a medium of exchange for goods. This system was also present during the barter age, where one commodity was exchanged for another, so long as both parties had use for each other’s commodities. However, searching for a person who wants the same commodity you wish to give up and would offer a commodity you need in return is inconvenient.

Here comes currency.

Currencies value the same good in monetary terms, by eliminating the time-consuming process of searching for a buyer willing to offer what you need. The assurance of its nominal value is also instilled by the central banks of the country. Individuals trust the central bank of their country, which is why they trade in currency terms.

No one will use currencies as a medium of exchange if it is volatile; in other words, what one dollar buys me today will be the same that it buys me tomorrow. Granted, in 10 years, it probably won’t buy me the same amount of goods, but on a year-by-year basis, the value remains fairly stable, as central banks closely monitor their respective currencies. The entire world cannot adopt one currency because their policy intervention role would be hampered.

Also Read: Who Makes Bills And Coins For An Economy, And How Do They Decide The Value Of Each?

The Mechanics Of Cryptocurrency

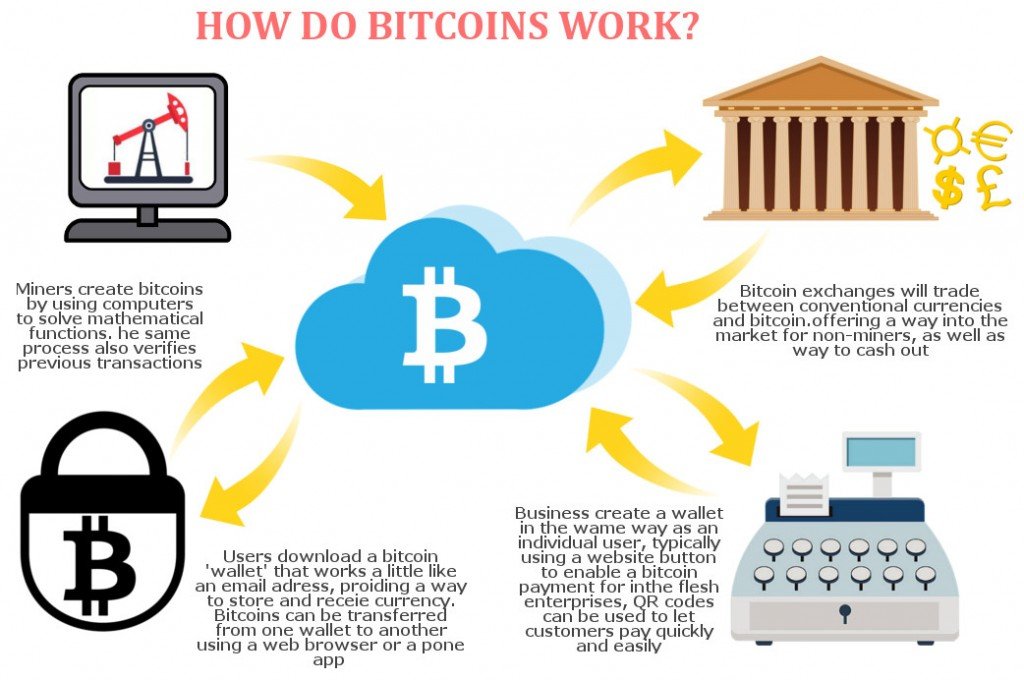

Cryptocurrency is touted as the most significant fintech innovation in recent history. Whenever a transaction is incurred using a cryptocurrency, each transaction links itself to a block; hence you can record the entire journey of a coin by looking back at its transaction history, with timestamps recorded in a ledger called a blockchain (More details on blockchain here).

The blockchain only records the journey of a coin; it does not disclose the purpose of the transaction or the counter-parties involved, thereby granting privacy. The process of recording the journey of each cryptocurrency coin is to ensure that each one in circulation is unique. This record is then broadcasted to all the computers in the network. Hence, it does not need any financial or social institution monitoring its authenticity.

Wonderful, right?

If no institution monitors a currency, it surpasses all biases and politics in the system. On the flip side, we’ve seen that for a currency to be used as a medium of exchange, it must first be universally accepted. Second, it must depict stability before being widely adopted for mediating transactions. However, there are some outlets that accept Bitcoin as payment for goods/services offered. However, the problem is the whole stability aspect.

Let’s look at the figures for Bitcoin- $47,733 was the value of 1 Bitcoin at the start of this year, but it stands at $18,931 as of September 25 of this year. The value has dropped by more than 50%, making the currency very unstable. These fluctuations result from a combination of factors ranging from demand and supply to government regulation and investor sentiments.

How Are Cryptocurrencies Created?

Just as central banks mint coins and print their respective currencies, cryptocurrencies are similarly “mined”. Mining is where the term cryptocurrency came into the picture because it is the process of miners solving cryptographic puzzles that require high-speed supercomputers and consume massive amounts of electricity. Once the puzzle is solved, a coin is added to the supply, which belongs to the miner and is also part of the overall circulation.

Mining is a very expensive affair! For some perspective, the volume of electricity consumed for mining is so massive that China had recently banned cryptocurrency solely because of its electricity consumption, as it posed a threat to the availability of electricity for other industries!

Also Read: How Does Bitcoin Mining Impact The Environment?

Central Banks’ Stand On Cryptocurrencies

Countries like El Salvador and the Central African Republic have adopted Bitcoin as legal tender because their currency is volatile, and for other geopolitical reasons, which we will not delve into.

However, no other countries have adopted it or currently plan to do so. Moreover, allowing the dissemination of private currencies would give birth to a parallel economy that would threaten the social fabric, as it would make the impact of policy decisions redundant.

Policy-making is an integral part of a central bank, as it regulates the flow of credit in the economy, thereby controlling interest rates. If this critical feature is taken away, then the whole system is under threat.

The role of monetary policy executed by central banks is to ensure price stability (control inflation) and aid the growth of an economy by managing economic fluctuations. This management is done by regulating the supply of currency, which is impossible with cryptocurrency, as anyone can mine it.

Thus, if a centralized agency does not monitor the supply of money to some extent, how can we ensure its value to be stable?

Moreover, the cost of the heavy electricity consumption for mining often tends to be higher than the currency’s face value. This is bad, as the face value is lower than the cost price of holding the currency! Finally, it is also a security threat because cryptocurrencies, if used in financing illegal affairs, can never trace the counter-parties involved. Although this threat exists with cash, if cryptocurrency is widely adopted, illegal cross-border transactions will be even easier.

Similarly, suppose some cryptocurrencies are widely adopted, despite these consequences; in that case, there is still going to be someone who manages that currency. In that case, the manager/entity would practically control the national economy. This poses a massive risk, as this entity will not be held accountable for acting in a country’s best interest, unlike a central banking institution.

All of this draws our attention to the direction of cryptocurrency. If it cannot be a store of value because of its fluctuations and it has no intrinsic value like gold, then is it just another speculative instrument that has taken the world by storm. At the end of the day, if the majority of people decide to stop using Bitcoin, its value will collapse to nothing.

How well do you understand the article above!