Table of Contents (click to expand)

Income and investments need to be adjusted for inflation so that the effects of inflation can be removed. Adjusting purchasing power for inflation means restoring its initial value. This helps in maintaining the same standard of living year on year.

The only remarkable thing about inflation is that if you spend the same amount on groceries, the bags are easier and lighter to carry home.

Not the right time for a joke?

Alright, now for the serious stuff. Let’s play out this scenario step by step.

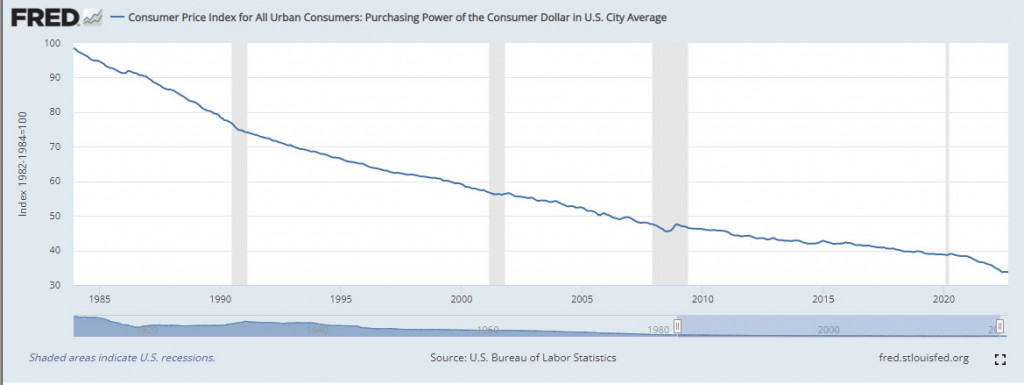

The same dollar buys you fewer and fewer goods each year, but not drastically less, which is why minimum wages, interest rates and other returns are usually adjusted for inflation. Adjusted means keeping the dollar’s value intact, which is possible only after deducting the effect of inflation from it. This value is determined by how many goods you can buy with it.

Why Do We Even Need Inflation? Why Can’t Inflation Be 0%?

Prices will fluctuate at an aggregate (economy) level for a number of reasons. It is usually the duty of the central bank and the government to keep a check on the inflation rates to ensure price stability. This fluctuation can either be upwards or downwards. When it goes upwards, the economy is said to be experiencing inflation, and when it is downwards, deflation.

Economists believe that some amount of inflation is imperative as it acts as an incentive for producers. Some inflation is required; otherwise, everyone would postpone their purchases, assuming that prices will go down in the future. If everyone adopts the same thinking of postponing their purchases, it will bring the economy to a standstill. Now, once spending reduces, businesses will stop hiring, affecting unemployment. Existing employees will also get paid fewer wages, and eventually an economy’s output (GDP) will be reduced.

Hence, some amount of inflation is a booster for an economy. However, the target rate adopted by countries varies. For instance, legally, the US Federal Bank targets inflation at 2%, but the Reserve Bank of India targets it between the limits of 2% to 6%, ideally at 4%.

Inflation and deflation are best understood as feedback loops. They need to be managed by the government and central bank from either spiraling upwards or downwards.

Stability in rates is important mainly for two reasons. First of all, most of the population lives on a fixed income, and if prices rise too quickly too soon, then earners will be unable to live on their current pay rate, as their purchasing power is eroded if prices keep fluctuating upwards.

Secondly, people will invest in risky ventures to make up for unpredictable price hikes. They will be left with no choice but to do this to maintain their living standards.

Both these effects will prove to be detrimental to an economy. On the contrary, a slow increase in price allows households to plan their consumption.

Simply put, inflation is definitely the lesser of the two evils and achieving stability is the key!

Also Read: Why Do Borrowers Generally Gain And Lenders Lose Out During Economic Inflation?

Purchasing Power And Inflation

To put it simply, the grocery bags get lighter because, with inflation, the same load of cash buys you less each year!

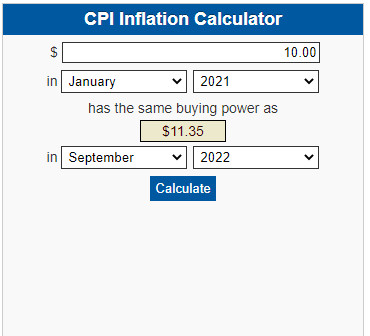

Hence, the purchasing power of any denomination is basically how much the currency can buy. Inflation in the US is usually around 2%. Now, this means that your purchasing power has to increase every year by roughly 2% if you want to maintain the same standard of living every year. This is because the prices of products will rise roughly 2% yearly. This also means that the nominal or face value of one dollar keeps declining by 2%, which is why you need that salary hike of at least 2% to keep up with the rising prices.

Remember that a rise in price does not mean the cost (price) of every good increases by 2%, but it’s an average rise in the prices of goods in an economy; some prices may even decline. The surge is calculated based on the central bank’s pre-fixed basket of goods.

The purpose of a minimum wage hike is to remove this effect of inflation. This compensation is done so that you can directly maintain a minimum standard of living. This means that, although it is a rise in your salary at face value (nominal terms), in real terms, you’re being compensated for an overall price rise.

When anything is adjusted for inflation, it reflects the real value and is also known as the real return. For instance, inflation-adjusted return on investment allows an investor to see the actual returns on an investment after deducting price hikes that affect an economy. Similarly, real wages are what remains with an earner after accounting for inflation. It provides a clearer picture of an earner’s wages regarding what goods and services they can buy.

Let’s take an example of inflation-adjusted return (real return) and inflation-adjusted wages (real wages). Suppose an investor buys a bond that assures a return of 2.5%. If the inflation rate in the economy is 2%, then the real return that the investor accrues is 0.5%, but if the inflation rate in the economy is 4%, then the real return is -1.5%, which means that the return did not keep up with the inflation and the investor should look for other investments with better returns.

Similarly, a person’s wage is $20 an hour, and inflation was 2% in 2021. Now, in 2022, if inflation rises to around 3%, then wages must also increase by 3%, which is 60 cents, so that the person can maintain the lifestyle they maintained when their wages were $20 in 2021. This is required to keep up with the rising prices of roughly significant goods in the economy.

Also Read: Why Can’t We Just Print More Money To Solve Our Financial Problems?

Conclusion

Even moderate and controlled inflation sometimes puts a lot of citizens in a financial fix. There are many periodic fluctuations above 2%, for example, the impact the Ukraine war has had on oil prices. Despite being compensated for an inflationary increase, the erosion of purchasing power can happen based on the goods a household regularly consumes. The measly 2% salary hike may not always help a family of 4 peacefully survive in such a rapidly changing world!

How well do you understand the article above!

References (click to expand)

- RRR Adjusted for Inflation - Overview, Formula, Example. Corporate Finance Institute

- CPI Inflation Calculator - BLS.gov - Bureau of Labor Statistics. The Bureau of Labor Statistics

- What are inflation expectations? Why do they matter?. The Brookings Institution

- Federal Reserve issues FOMC statement of longer-run goals .... The Federal Reserve System

- RESERVE BANK OF INDIA ACT, 1934. The Reserve Bank of India